When $8.55 an hour is not $8.55 an hour

The Broken Calculator

The Uber driver wage report issued by researchers from M.I.T. and Stanford University in February 2018 was recalculated March 5th and now reports that the median wage for Uber drivers in the U.S. is $8.55 an hour after average projected car expenses. Unfortunately, the authors of the report compare the earnings to minimum wages across the U.S. without accounting for the broader expenses and acute risks of using a personal car in commercial work while being classified as an independent contractor.

Additionally, the source for the survey group that was polled for this data are existing Uber drivers that have signed up for an online forum called “The Rideshare Guy”. But who is not surveyed are the drivers who are otherwise not connected to this particular social media blog. Some drivers might be disadvantaged and not have a home computer, or not be web savvy on how to find and connect to these platforms. Others may have language issues, or tried the Uber platform for just a few weeks or months and could not make it work and so they quit. The job pays poorly and unanticipated expenses accrue quickly. Who knows how many gave up before looking online for a place to learn best practices from or perhaps to air their displeasure? This is a significant factor because other surveys have shown over 65% of the workers that make it through the Uber application process and begin driving actually wind up leaving within 6 months. And those departures begin just a few weeks after starting on the road. A survey group of existing drivers would then naturally include many who are new and financially inexperienced. The Rideshare Guy forum is also a major source of advice and commentary and is frequently cited in news articles. Forums like The Rideshare Guy attract drivers that are serious about driving and want to learn the ways to boost their income. But the site has promoted their own referral codes that generate revenue for the site when new drivers use them to sign up. Driver’s also receive bonuses for using the codes. Other revenue for the site comes from advertising by ridehail industry vendors such as insurance companies and accounting software. Subscribers to The Rideshare Guy are beneficiaries of these programs and the advice provided, and may not represent the whole of Uber’s driver base.

Here’s The Real Problem

But even if you do accept that the survey group is indeed representative of the whole of Uber’s driver experience there is even another, more significant problem with their study: The authors of the MIT study report that the pay that they deduce from their survey is below the minimum wage set for employees in most states. Unfortunately, this comparison itself suggests a misleading framework for interpreting the statistics gleaned from the survey. That’s because the authors subtract only their own estimation of per-mile vehicle operational costs from the Uber driver’s gross earnings to find driver’s net income. The problem with that methodology is that ridehail drivers are always classified as independent contractors and the The Federal, State or Municipal minimum wage they compare to is always set for workers that are legally classified as employees. That difference is extremely relevant because employee classified jobs automatically come with a long list of required safety rules, financial protections, social benefits, and perks that most of us take for granted. Certainly, the costs of operating a personal vehicle as a taxi are significant, but there is a long list of other substantial costs not accounted for in the MIT calculations. Additionally, ridehail driving turns out to be unusually risky work both physically and financially and ridehail drivers simply have no protections at all.

The “Be Your Own Boss” Costs

First, the small stuff. Workers in fields that frequently use independent contractors like accounting, computer programming, or consulting know that the rates they charge clients have to be significantly higher than the wage they would otherwise get for doing the same work as employees. The independent contractor classification means that a worker must conduct themselves as a proprietor of a business. They incur many costs not borne by employees, and in the case of Uber drivers, these costs go beyond the specific costs of operating a vehicle. For ridehail drivers, it might mean downtime for repairs, car wash, traffic court, pay disputes, insurance shopping, accident resolution, licensing, bookkeeping, tax preparation and more. Not only do rideshare workers experience these costs but they are also exposed to critical risks unique to ridehailing which can cause serious financial harm.

Ridehail drivers must pay what an employer would normally contribute to social safety net funds. This “self employment tax” (about 17%) pays for social security and medicare and in some states it replaces the employer’s social welfare contributions. This tax is due at tax time and is not withdrawn by the employer when checks are issued. In many jurisdictions, ridehail drivers are also required to have a business license, airport or municipal permits, vehicle inspections and other regulatory costs normally incurred by employers. They also have to bear the occasional parking or traffic ticket.

Independent contractors must do their own accounting for expenses, keep mileage and maintenance logs, file quarterly taxes, maybe use a bookkeeper or accountant, and perhaps buy accounting software. They certainly have to change their spending behavior and put a portion of their pay into savings accounts for future car repairs, car insurance deductibles, and to fully pay for those upcoming income taxes because nothing is being withheld from their paychecks by their bosses. For many drivers, this is their first independent contractor job and are unaware of these problems. Many ridehail drivers are on the edge of financial stability when they start the job and need to spend all their earnings immediately, leaving themselves owing more in the future. This create a snowballing indebtedness that keeps them from getting ahead or leaving the program.

Can We Assign Fixed $ Numbers To Job Risks?

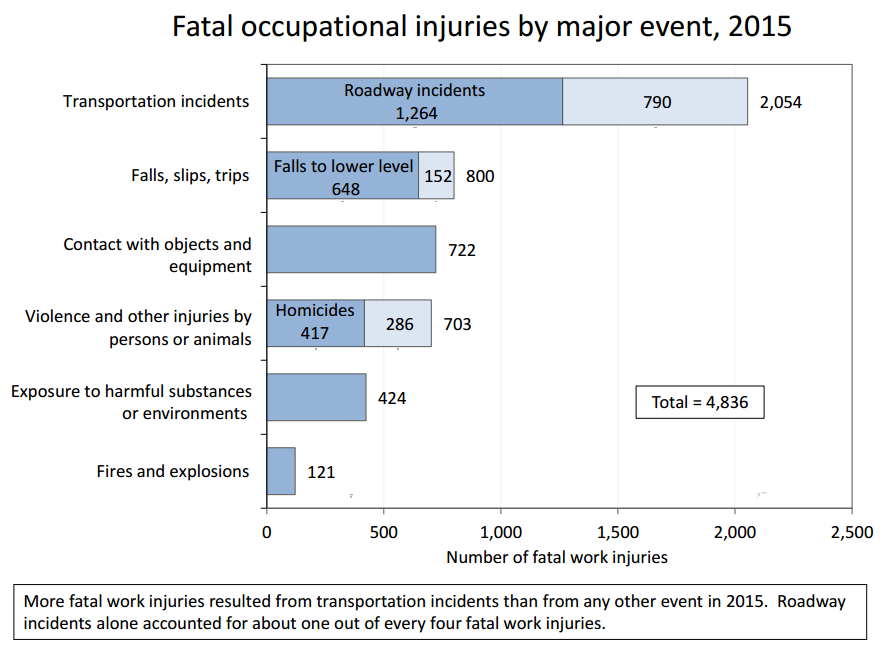

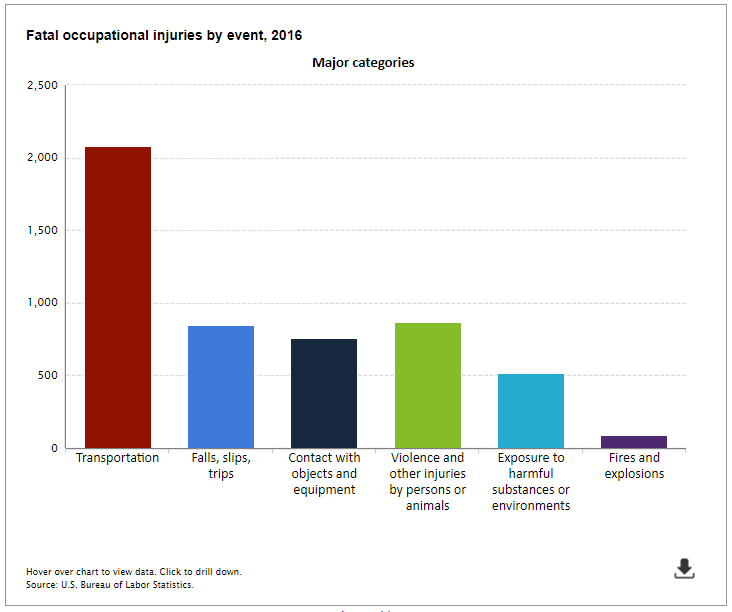

But the major issue is that TNC drivers do not have workers compensation coverage to help with all the costs and consequences of work related injuries or death. Workers compensation coverage normally costs a transportation company employer between 10% and 20% of a driver’s wages. Driving is the #1 source of job related fatalities for all industries in the US, and is also the dominant source of job related injuries! Taxi driving is one of the top contributors to this alarming statistic and ridehail drivers add further risks by watching their cellphones while driving, and having to accept immediate requests. Many social media forums complain about sudden turns by urban ridehail drivers across several lanes of traffic, cutting off other cars or making unsafe U turns in the middle of blocks to respond to nearby ride requests. Unfortunately no reliable public statistics are available on ridehail accidents vs the general population.

Workers compensation insurance not only covers all medical costs related to workplace injuries, but it also importantly provides substitute wages during their recovery period. It covers transportation to medical appointments, an important factor when the driver’s car is out of action from an accident and they cannot work to pay for the repairs. It will cover the driver’s continuing therapy and rehabilitation programs when needed, and even retraining in a new field should the worker incur a disability that prevents the them from continuing in the same line of work. Workers and their families will receive a lump sum settlement for a permanent disability and in the event of a work related death, the worker’s remaining dependents receive an initial death benefit award plus a program of significant payments over a number of years to replace the lost income of the household’s breadwinner.

What Happens When A Simple Accident Takes Your Job Away?

Besides the benefits of workers compensation, ridehail drivers and their families also frequently lose the use of the family vehicle while waiting for an insurance check to cover the car repairs, and ridehail companies suspend the driver until the car repaired. Frequently, after an accident, injured drivers are unable to work in order to pay for those repairs and with no working car, simply cannot get themselves to the doctor. Even if the accident is covered by the ridehail insurance, the Uber deductible is still $1,000.00 and the Lyft deductible is a whopping $2.500.00. If the accident is the fault of the other driver, they still cannot work until the car is repaired or they are physically able to return to work. Insurance settlements can take weeks, months, or even longer in the case of litigation. Many ridehail drivers have little or no financial resources when they start the job and the combination of a wrecked car, medical bills and inability to work tips them into welfare or homelessness. Limousine, taxi, and transit drivers that have an accident are nearly all covered by workers compensation if injured, and have the opportunity to drive another fleet vehicle on their next work day.

Driver’s also take the risk of losing their income stream for being fired (deactivated) simply because of poor customer ratings. Because of their independent contractor status they are not eligible for State unemployment benefits or to argue that they were dismissed unfairly. Drivers also must to find a health plan for themselves and their family without an employer contribution. A recent search for the term “Uber” at the public charity site GoFundMe, found over 10,000 pleas for assistance, many from drivers and their families having to cope with everything from an unexpected car repair that keeps them from working, to drivers and families desperate because the breadwinner has been seriously injured or killed.

Using Your Car For A Pay Day Loan

Ridehail work is very similar to taxi work and the cars take extraordinary wear and tear as taxi drivers know. This substantially affects vehicle value, accelerating the depreciation and silently taking money out of the driver’s pocket. Most ridehail work is conducted in dense urban areas, and scratches, scrapes and dings are a common occurrence. Most blemishes cost less than the deductible on their insurance policy so they frequently don’t get fixed. This further accelerates the depreciation and creates a snowballing bill when it comes time to sell the car. When that time comes many drivers find out that their vehicle is worth less than the balance on the car loan and they have to cough up the difference. Many drivers are unaware of this problem and others are simply willing to accept this “payday loan” from the equity in their car because they need the cash.

Unfortunately, his bill can suddenly come due after an accident when the cost of repairs exceeds the reduced vehicle value. The insurance will only pay up to the actual cash value (ACV) and in many cases the driver cannot come up with the repair difference to put the car back on the road. If you think this might be a rare problem then check the GoFundMe site for the details of this common trap. Even the creators of Uber’s famously failed “Exchange“car leasing program did not properly estimate how tough the work is on vehicles and how quickly they depreciate. The MIT story properly mentions Uber’s wild underestimation of leased vehicle depreciation in that program. Uber charged extraordinarily high lease rates compared to common leasing programs. But the Exchange program still lost an average of $9,000.00 on each vehicle leased to drivers, even when most cars were quickly given back to the lease company within 18 months!

A Risky Work Environment Even Without The App Turned On

Then there are other risks that should be compensated for in the pay scheme because of work related personal harm or property damage. Hundreds of drivers have been shot, killed, assaulted, robbed, carjacked, had their car damaged or stolen while commuting, eating or resting between work shifts. These are significant risks and do not occur in other jobs. No ridehail insurance or workers compensation program will currently cover these coasts. Driving late at night,in bad neighborhoods or unfamiliar streets, or driving long miles to and from the work area all take their toll. Much of the public perception problem here is these occurrences are statically incidental items. When problems like worn seats, door dings, are combined with hostile street encounters they become significant work risk factors, but unfortunately are not adequately recorded for analysis. When brought to the public’s attention, they seem like they are being over emphasized when they are not.

Then there are other risks that should be compensated for in the pay scheme because of work related personal harm or property damage. Hundreds of drivers have been shot, killed, assaulted, robbed, carjacked, had their car damaged or stolen while commuting, eating or resting between work shifts. These are significant risks and do not occur in other jobs. No ridehail insurance or workers compensation program will currently cover these coasts. Driving late at night,in bad neighborhoods or unfamiliar streets, or driving long miles to and from the work area all take their toll. Much of the public perception problem here is these occurrences are statically incidental items. When problems like worn seats, door dings, are combined with hostile street encounters they become significant work risk factors, but unfortunately are not adequately recorded for analysis. When brought to the public’s attention, they seem like they are being over emphasized when they are not.

In one of many cases, Alex Quintara, a California Uber driver shown above while in the hospital surrounded by his family is representative of these issues. His family posted this picture on GoFundMe to raise money for his injuries suffered from an attack by a group of motorcycle riders while commuting to Uber work in San Francisco from the Central California town of Modesto. A more accurate picture of the power of these unpredictable incidents comes when reporters, researchers or bloggers become full time drivers as part of their journalism efforts to find the real story. Many end their investigation when assaulted, ripped off or suffer uninsured/underinsured damage to their vehicle.

Missing Job Benefits That We All Take For Granted

Additionally, many employment jobs include paid sick days, vacation days, health insurance plans and other benefits. If a grocery clerk drops a glass bottle in the store, they do not have to pay for it. But independent contractors are responsible for all job related expenses, and obviously as the above example show, many cannot be anticipated and formally account for.

In summary, workplace benefits are critically important for minimum wage workers and are frequently a significant factor in keeping a dependable stream of income. A contracting worker who misses a week of work because of the flu might otherwise miss making rent. A worker injured on the job may face similar time off and medical bills way beyond their means. These critical employee benefits have been developed over time not simply as charity, but because of a broad societal need to keep workers gainfully employed, off public assistance and welfare roles, out of homelessness and the potential default on everyday obligations to their community. In nearly all cases the law has decided that the provider of these workplace benefits should be the employer.

The ridehail industry has now created a new and unique social quandary by putting personal or family cars to use and at risk for commercial gain. A personal car is almost everyone’s first or second most important investment. It is also key to their personal mobility, providing access to work, healthcare, and shopping. The loss of this mobility is especially critical to low income households. Unfortunately the ridehail industry thinks that risk belongs only with the vehicle owner or driver and not with the creator of the job or the maker of job rules and requirements. Even those who take on this work as a side job put their main jobs at risk by potentially losing their mobility. Additionally, the low pay of these jobs makes the target of this work proposition those that are on the edge of economic stability and the least capable of handling the risks and misfortunes. While this targeting may seem coincidental, the ridehailing companies use of subprime loans and onerous leasing programs has pulled away that veil. Many of the ridehail applicants are immigrants with few alternatives for feeding themselves and their families in their new-found realm.

Here’s Your Homework

For any reader that thinks these risks are overblown, please take the time to browse sites like GoFundMe and see the scale of social upheaval. For other readers that want to look deeper, here are publications from governments, academics and non-profit research groups that study this important dilemma.

The Economics of Ride Hailing: Driver Revenue, Expenses and Taxes

https://orfe.princeton.edu/~alaink/SmartDrivingCars/PDFs/Zoepf_The%20Economics%20of%20RideHialing_OriginalPdfFeb2018.pdf

Sweated Labor, Uber And The Gig Economy

http://www.frankfield.co.uk/upload/docs/Sweated%20Labour%20-%20Uber%20and%20the%20’gig%20economy’.pdf

Good Work, The Taylor Review Of Modern Work Practices

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/627671/good-work-taylor-review-modern-working-practices-rg.pdf

An Analysis Of The Entrepreneurial Aspects Of Uber’s Drive-Partner Platform

https://www.brown.edu/academics/engineering/sites/brown.edu.academics.engineering/files/uploads/UberCaseBrownUniversityMcQuown.pdf

Will The Growth Of Uber Increase Economic Welfare

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2933177

Uber As A For-Profit Hiring Hall: A Price Fixing Paradox and Its Implications

https://scholarship.law.berkeley.edu/cgi/viewcontent.cgi?article=1505&context=bjell

Algorithmic Labor and Information Asymmetries: A Case Study Of Uber Drivers

https://starkcontrastdotco.files.wordpress.com/2016/08/4892-21331-1-pb.pdf

Subsidizing Billionaires: Simulating The Net Income Of Uber X Drivers In Australia

https://d3n8a8pro7vhmx.cloudfront.net/theausinstitute/pages/2692/attachments/original/1519989285/Subsidizing_Billionaires_Final.pdf?1519989285

More Than a Gig: A Survey of Ride-hailing Drivers in Los Angeles highlights the lived experiences and job conditions of drivers working in the gig economy.

https://www.labor.ucla.edu/publication/more-than-a-gig/

Research reveals sharing economy ‘myth,’ argues for regulation of firms such as Uber, Airbnb

https://news.iu.edu/stories/2018/03/iub/releases/19-myth-of-the-sharing-economy.html

Towards a Fairer Gig Economy: Oxford Internet Institute

https://www.oii.ox.ac.uk/blog/towards-a-fairer-gig-economy/

An Earnings Standard for New York City’s App-Based Drivers: Economic Analysis and Policy Assessment

http://www.centernyc.org/an-earnings-standard/

A median ridehail wage $8.55 per hour should not be compared to the minimum wage of a worker classified as an employee but rather to the median net wage of other independent contractors. And the gross driver pay before expenses should be compared to the gross wages in those other independent contractor job categories. That gross figure for independent contractors in the U.S. is published on the web and averages $47.00 per hour. Compare that to the claimed before expense earning of ridehail drivers. Even the average handyman charges between $60-65/hr and brings his own tools and drives himself to the job site.

The “Be Your Own Boss” come-on by the rideshare industry snags many an unsuspecting victim. The GoFundMe site along with other charity forums open windows into some of the unfortunate realities of the gig economy. Looking there, you will find not only needy ridehail drivers and families pleading for critical assistance because of driving related misfortunes, but you will also find hundreds of desperate unemployed men and women wanting a few hundred dollars to enter a ridehail leasing program or even more money to buy a car so that they can start work as a ridehail driver. All they would need is a qualifying car and they would not only have a job, but regain their mobillity. Such a proposition seems so enticing, but once on board, the vast majority become disappointed with their earnings and quickly leave. Only 4% of this wishful group are left driving after 1 year, many ending up worse off than when they started. Some, even less fortunate, find themselves unable to leave because of their snowballing obligations.

Is this really $8.55 an hour? Welcome to what one blogger calls “Lipstick On A Gig”.

As a 27 year seasoned livery operator I have found the average NET hourly income for the average rideshare driver ranges from $3.15-3.55 per hr nationally. The average gross fare is $13.55 with the transfer being 42 minutes portal to portal. Uber takes from 25-40% off the gross fare plus any miscellaneous expenses. The driver pays all operating expenses, including all taxes 14.5% self employment tax. Then the diminished value of his vehicle must be calculated. Soon the driver realizes he was suckered into a bad deal by all the hyped fraudulent recruiting ads and quits. The rideshare driver turnover is 30-60days and more aggressive fraudulent advertisements are placed on social media, and national media. THE BUSINESS PLATFORM HAS BEEN TOXIC FROM INCEPTION. Uber and Lyft refuse to comply with just the basic US CODE 49 (390.5). Any for-Hire- Motor Carrier means a person engaged in the transportation of goods or passengers for compensation. The law is clear. The driver must have OPERATING AUTHORITY, primary commercial public auto liability insurance, a USDOT medical card, file a BCS-150 for each year and be police vetted. Further, I-9 and green card verifications must be validated. The driver is subject to the rule… Read more »

Uber, Wag, Door Dash.. they all deduct fees from gross instead of “off the top”. It’s also known as a royalty for use of logo. It’s symbolic IP. Not sure how Wall street has not caught up to the scam with franchise accounting. Real Estate firms do the same type of math. Look up ASC 606. Also the firms control the rates. See the trend. Soft Bank/Vision Fund invests in companies with a platform of 1099s deduction fees off of gross revenues (they also are heavily invested in Compass Real Estate). It’s master franchising or master scam. Look up attorney Rochelle Spandorf. She writes about franchising. If Uber drivers are paying a fee for use of logo, are drivers sub-franchisees?